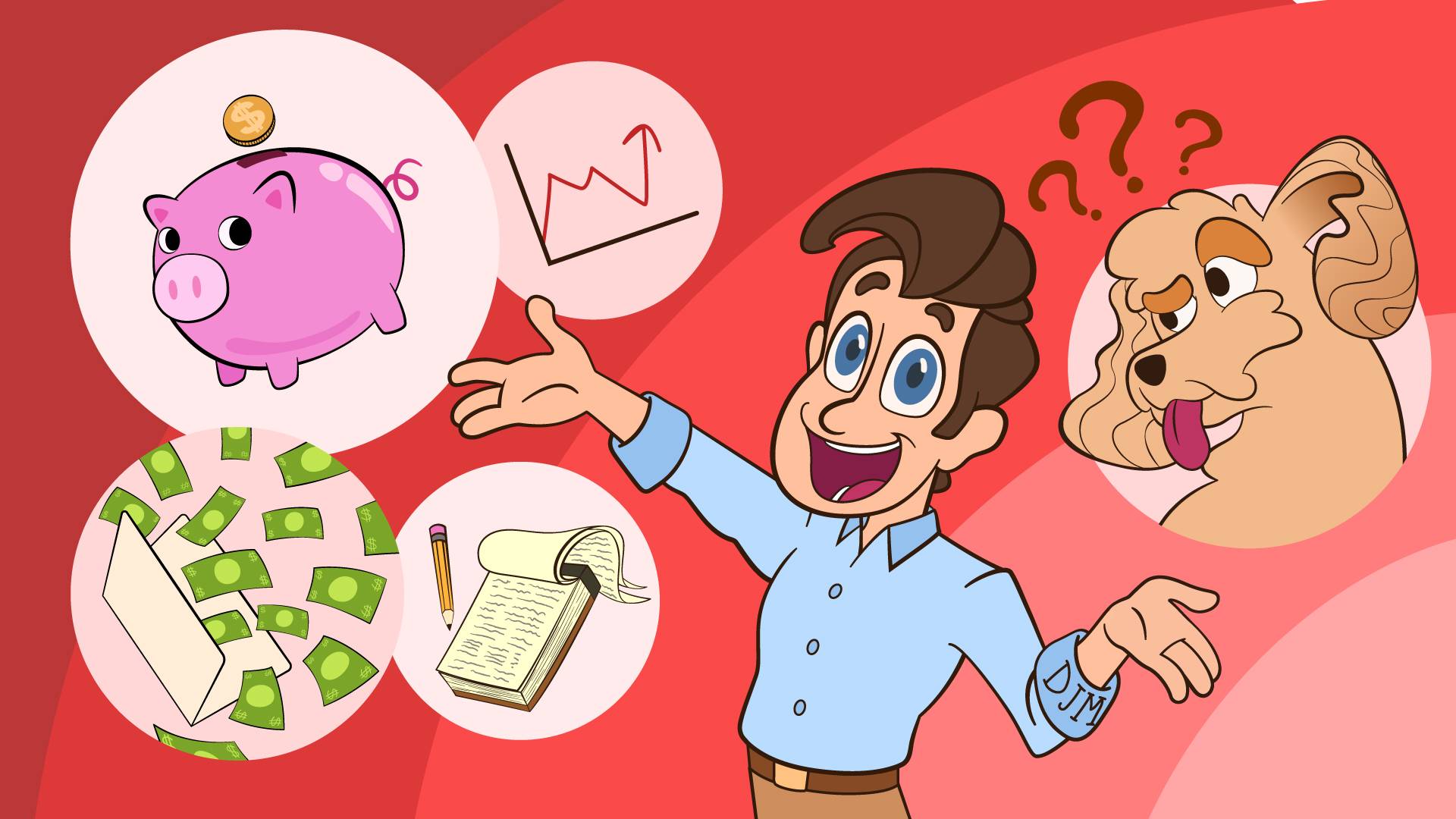

Personal finance is an important aspect of our lives that can often be overwhelming and confusing. From budgeting and saving to investing and managing debt, there are many factors to consider when it comes to managing our financial health. As a registered investment advisor, I understand that it can be difficult to know where to start, so let’s begin with the basics.

Budget

The first step in managing your personal finance is to understand your income and expenses. This means creating a monthly budget and tracking your spending. Not only does budgeting provide insight into how your money’s moving, it also helps you evaluate what is worth keeping as an expense. (Maybe you don’t need twenty different streaming service subscriptions!)

There are many apps and tools available to help you get started. Our budgeting worksheet is a good resource to help your budget for retirement.

Saving

Once you have a good handle on your budget, it’s time to start asking yourself: “How much do I need to save each month to pay for x?”

Saving money is important because it provides a safety net for unexpected expenses and helps you to achieve your financial goals, such as a new car or retirement. There are many ways to start saving, such as creating a savings account or investing in a retirement account. You should find a savings plan that works for you and to stick to it.

Investing

Investing is an often talked about aspect of personal finance. It’s the process of putting your money into assets that have the potential to grow in value over time. This can include stocks, bonds, real estate, and more. Although investing is an additional income stream, it’s important to understand the risks involved and to do your research beforehand. What is your risk level and how much are you willing to invest?

Debt

Managing debt is very important to your overall financial health. Debt can come in many forms, such as credit card debt, student loans, and mortgages. You can start tackling you debt by understanding how much you have and to create a plan to pay it off. This can include creating a debt repayment plan, consolidating your debt, or seeking professional help.

In conclusion, personal finance is a complex and ever-evolving topic. However, by understanding the basics, you can take control of your financial health and achieve your financial goals. If you need help or have any questions, don’t hesitate to reach out to a registered investment advisor like myself. Remember, the key to success is to start small and take it one step at a time.

“Empowering your financial journey with FMF365.com and me, Virtual Dan!”

-Virtual Dan