Retirement Income for Beginners

If you’re like most people, you’ve likely spent the bulk of your career saving for retirement. While saving for retirement is important, it is equally important to make smart savings decisions. Why? The money that you save will eventually become your retirement income. We realize saving for retirement can seem daunting, but it is not as difficult as it seems. A retirement income strategy can make planning for retirement a piece of cake.

If you want to start developing a retirement income strategy, first think about how you want to enjoy your retirement. Do you want to travel the world or spend more time with loved ones? Next, you’ll need to determine the associated costs of your ideal retirement. This will help you live within your means and have an enjoyable retirement. The next step in building a retirement income strategy is learning how to make wise investments that maximize returns. If you don’t know how to turn your nest egg into a steady flow of cash for retirement, we can help. The FMF365 team highlighted seven sections of retirement income – income planning, employer-based pension plans, IRA rollover process, IRA withdrawal, cash flow planning & creation, withdrawal rules, and required minimum distributions – to help you achieve financial health and wealth during your retirement.

Sources of Retirement Income 101

If you’re like most working adults, you have only one source of income – your job. While one source of income is fine for working adults, it is not feasible in retirement. Retirees rely on multiple sources of retirement income to replace their salaries. If you’re new to retirement planning or want to learn about retirement income sources, keep reading.

Sources of Retirement Income Categories

Retirement income sources range from small to large. As for other investments, it is important to diversify your sources of retirement income for optimal returns. But first, you need to identify income sources. The simplest way to determine retirement income sources is to think of your assets as belonging to one of a few buckets. Breaking down your income into buckets will help you match your income to expenses and make sure that critical needs are satisfied. Income buckets will also create a big-picture overview of what is required to generate lasting retirement income. So, gather your assets and mark them by category.

Category 1: Pre-Tax Assets

Investment contribution made before taxes are deducted.

- 401(k) or 403(b) Employer Plan

- Lump-Sum Pension Payouts

- Rollover IRAs

Category 2: Tax-Free Retirement Assets

Investments that are exempt from taxes on income earned.

- Roth 401(k) Employer Plans

- Roth IRA

Category 3: Non-Qualified Assets

Investments that don’t qualify for tax deferment or exemption.

- Savings Bonds

- Brokerage Account

- Mutual Fund Account

- Stocks

- Excess Savings

Automatic Sources of Retirement Income

You’re probably wondering, “What sources of automatic retirement income will I have?” Well, there are seven types of automatic retirement income:

- Social Security income (refer to Social Security section to calculate the benefit)

- Spouse’s Social Security income (refer to Social Security section to calculate the benefit)

- Employer pension plans

- Spouse’s employer pension plan

- Rental income

- Non-qualified dividend income

- Part-time work or business income

Employer-Based Pension Plans

Employer-based pension plans (aka employer-sponsored plans) are one of the many sources of retirement income. Like other retirement assets, pension plans can help sustain your lifestyle when income generation slows down. There are several retirement pension plans, so it’s important to understand the basics before planning for your financial future.

What Are Employer-Based Pension Plans?

Employer-based pension plans are a free or low-cost benefit provided to employees. Most plans consist of contributions from both employers and employees, which helps employees grow their investments faster. Retirement pension plans cover expenses ranging from healthcare to retirement; employers make all of the investment decisions and are subject to all the risks. Employer-based pension plans are considered defined-benefit plans because retirement benefits can be calculated to determine the size of future payments.

Although the focus of this article is employer-based pension plans, it is worth mentioning defined-contribution plans. These plans allow employees to contribute a percentage of their income to fund their retirements. Defined-contribution plans allow employees to receive income after retiring. This retirement plan is typically tax-deferred. In other words, employees contribute pre-tax money.

Pension Plans Payouts: Lump Sum vs. Monthly Income

As you near retirement age, it is important to decide how you want your retirement pension funds to be distributed.

Lump Sum Pension Plans

As the name suggests, lump sum pension plans are distributed all at once, giving you access to a large sum of money. Lump sum pension plan benefits include the following:

- Lump-sum payouts can remain nontaxable if rolled over to a pre-tax IRA

- Beneficiaries can get paid in full upon your passing

- Beneficiaries can change by your discretion during your lifetime

- Any amount can be drawn from pre-tax IRA by your discretion

- You can create your own cash flow

The Lump Sum Option

The lump sum option payout is calculated using three main factors:

- Monthly pension amount

- Your age

- Actuarial factors based on mortality tables and interest rates

Lower interest rates generally equal a higher lump sum payout.

Monthly Pension Plans

This type of pension plan is delivered to retirees once a month for the rest of their life. Monthly pension plan benefits and options include the following:

- Steady cash flow

- Guaranteed as long as the company stays solvent

- Spousal payments – second-to-die choices available

- If a single life is chosen, you cannot change it at a later date

Retirement Planning

Ready to start planning for your retirement? If so, use our free tools to achieve financial health and wealth.

The IRA Rollover Process

Do you have a 401(k) plan from a previous employer? Have you thought about switching your IRA to another financial firm? Do you want to maximize your retirement savings? If you answered yes to any of these questions, you’ve come to the right place. Keep reading to learn about IRAs, how rollover IRAs work, and more.

What Is an IRA?

An IRA (individual retirement account) is one of the most common investment tools to help you save for retirement. There are several types of IRAs, including:

- Traditional IRA

- Simple IRA

- SEP IRA

- Roth IRA

All types of IRA offer tax-deferred investment growth.

What Is an IRA Rollover?

Put simply, an IRA rollover is the process of withdrawing the proceeds from one retirement plan and then depositing them into another tax-deferred IRA. Most rollover IRAs can be completed electronically – however, due to 401(k) plan complexities, a slower, more manual process may be required.

What Is the Purpose of an IRA Rollover?

The purpose of an IRA rollover is to protect and maintain your tax-deferred benefits. Retirement assets left with a former employer are subject to taxes. Thus, IRA rollovers will help you save for your future and ensure your retirement income continues to grow tax-deferred.

IRA Rollover Process

If you have an IRA that you want to roll over, follow these four easy steps:

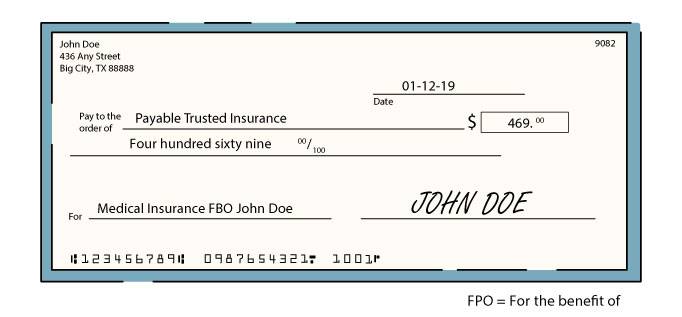

Step 1: Open an IRA with a trusted financial institution.

To ensure your tax-deferred money is safe, never have your rollover checks made payable to anyone other than the trusted financial institution you selected.

Step 2: Request a plan distribution from your former employer.

Step 3: Fill out any required plan paperwork – indicate your new rollover IRA information.

Step 4: Deposit rollover check into your new rollover IRA.

Trustworthy IRA Rollover Specialists

As a trusted financial institution, we’ve helped people achieve financial health and wealth. If you’re ready to build your financial foundation or make smart investments, we can help. Contact us to get started today!

IRA Withdrawal

You can withdraw money from your IRA at any time and any age. However, by doing so, you might put yourself at risk for penalties and additional taxes. If you’re not familiar with IRA rules, we’re here to help. Keep reading to learn about traditional IRA and Roth IRA withdrawal rules.

Traditional vs. Roth IRA Withdrawal Rules

| Traditional IRA (Rollover IRA) | Roth IRA |

|---|---|

| Must be at least 59½ years old to avoid 10% early withdrawal penalty | Must be at least 59½ years old to avoid 10% early withdrawal penalty |

| Any amount withdrawn will be added to your income for tax purposes in the calendar year of the IRA withdrawal | No taxes are owed on a qualified distribution |

| You can have taxes withheld by instructing your trusted financial institution | |

| Required minimum distributions begin annually at age 70½ | There are no mandatory withdrawals from a Roth IRA |

IRA Withdrawal Help

Before beginning the IRA withdrawal process, consult with a trusted financial advisor. They can help you avoid penalties and set you up for financial health and wealth. If you don’t have a trusted advisor, we are here to help.

Retirement Cash Flow Planning & Creation

For most adults, retirement is a big transition, and you probably have questions about cash flow management. What are the different types of cash flow assets? Will those assets be enough to sustain your lifestyle? Or how can you increase your retirement cash flow assets? For answers to all these questions and more, keep reading to get the inside scoop on cash flow planning.

Cash Flow Assets

During retirement, you will likely have several cash flow assets. Let’s take a look at some of the most secure sources of cash flow.

Cash Flow Asset: Social Security

- Designed to provide 40% of pre-retirement income

- Adjusted for inflation

- Every January adjusted for cost of living

- You can count on this payment showing up on time every month

Cash Flow Asset: Employer Pension – Monthly Income

- Usually not adjusted for inflation, which means your payment will stay the same every year even though the cost of pizza will continue to rise

Cash Flow Assets: Dividends

- Company Dividends

- A dividend is a reward to the shareholders of the stock.

- Companies pay dividends typically from their excess profits.

- Many companies will continue to pay their dividends even in quarters without profits just to maintain the track record.

- If a company runs into cash flow issues, the company has the right to not pay those dividends if necessary.

- Dividends are NOT guaranteed; however, if you invest in the right companies, dividends can be a steady source of regular income.

Cash Flow Asset: Capital Appreciation

- The growth of your investments is called capital appreciation.

- Sometimes investing in growth stocks or mutual funds can grow your wealth.

- Simply selling off some of the investments is another way to provide retirement income.

- Example: Let’s say you bought Amazon stock at $900 a share in 2017, and by 2019 Amazon stock grew to $1800 per share. You doubled your money. If you decide to sell some of the stock, that growth can be transformed into income.

Cash Flow Asset: Interest

- Interest is money paid regularly at a particular rate for the use of money lent.

- Example: If you invest in a three-year CD at 2.00%, the bank will use your money for the next three years and pay you interest on that money.

- Corporations also borrow money. They issue corporate bonds, which the underlying company agrees to pay back in full plus interest. Bond interest payments are another useful way to create retirement cash flow.

Cash Flow Planning Made Simple

If you’re ready to start planning for retirement, we can help. Use our robo investment tools to begin your cash flow planning journey and start tracking your cash flow assets. Sign up today!

Portfolio Withdrawal Rules to Follow

Managing income during retirement can be difficult. How much can you safely withdraw from a retirement portfolio? Knowing the answer to this question will help you avoid spending your money too fast and, most importantly, will help you live comfortably during retirement. Set yourself up for success during retirement with our portfolio withdrawal rules to follow.

4% vs. 6% Withdrawal Rules

| 4% Withdrawals | 6% Withdrawals |

|---|---|

| The 4% rule is the rule most financial planners use as a safe withdrawal rate, since the withdrawals would consist of mostly interest or dividends. | I see 6% as a more reasonable withdrawal rate. If you have $100,000 and withdraw $500 per month, which is $6,000 per year, then account for 2% annual inflation for withdrawal needs. If you earn 8% per year, your final payout will be at age 120. |

Portfolio Withdrawal Tip

Every year, you should determine how much you withdrew last year as a percentage of the asset. You can use the information to forecast the following year’s expected withdrawals and calculate the share of the total asset. If the percentage is over 6%, a new budget should be developed to reduce your spending.

Portfolio Management

Portfolios can be managed and held in your FMF365/Fidelity Investments account in any of our three stock-based or mutual fund–based strategies. Learn more and start investing today.

Required Minimum Distributions

In the IRA Withdrawals section, we explained that qualified retirement money cannot be withdrawn until the age of 59½ years, unless you’re willing to pay the IRS penalty of 10%. There is also a second age that is important. It’s age 70½, when all American taxpayers become subject to the Required Minimum Distribution (RMD) rules. The IRS provides a table to calculate one’s RMD.

IRS RMD

| Age | Distribution Factor |

|---|---|

| 70 | 27.4 |

How to Calculate RMD

If you want to calculate RMD, you need to collect all of the previous year-end values of your qualified investment accounts. Next, you’ll add them together. That total will be divided by the corresponding distribution factor on the IRS RMD Table.

One thing to notice is that the divisor number gets smaller as you get older. The smaller the divisor, the higher the percentage that must be withdrawn by year end to satisfy your Required Minimum Distribution. For example:

- Your first RMD at age 70½ is 27.4, which equals a 3.6% withdrawal.

- At age 75, your distribution factor is 22.9, a 4.4% withdrawal.

- By age 90, the divisor is 11.9, which equals a withdrawal of 8.8%.

Regardless of age, when RMD is withdrawn, it must be reported as income.