Build Your Financial Foundation

Like anything in life, success is built on a strong foundation. Financial success is no different. Every aspect of our lives, from buying a home to purchasing a car, is affected by our finances. So, it is important to build a foundation that helps you achieve financial health and wealth

Building a strong financial foundation doesn’t happen overnight. It is also not the result of making a few good financial choices. A rock-solid foundation can take years to achieve and requires constant monitoring. If you want to learn more about building a strong financial foundation, we are here to help. The FMF365 team highlighted seven sections of personal finance – credit 101, personal net worth, compound interest, pay yourself first, life insurance, automobiles, and the rule of 72 – to help you achieve financial health and wealth.

If you’re ready to build a foundation, we can help. Visit our simple, digital investment portfolio to achieve financial health and wealth. Learn more!

Credit Score, Credit Report, and Impact on Score

When you think of credit, chances are credit score, credit report, and good credit come to mind. Do you know the importance of the phrases? If not, you should! The health and history of your credit impact your ability to obtain loans, purchase a home, and even use cell phone services. Therefore, you must understand how credit can affect your life and well-being. Keep reading to learn about the basics of credit.

What Is Credit?

Credit is borrowed money used to buy goods and services (transportation, clothing, etc.) that you agree to pay back. In other words, you’re borrowing money to purchase or use something with the promise to pay it back later. Credit cards and loans are the most common forms of borrowed money. If you want to borrow money, a lender will look at your credit history and credit report to determine your eligibility.

Credit Report

Credit history is a report of all the money you’ve borrowed throughout your life outlined in your credit report. There are three credit reporting agencies (CRAs) that record your credit history every month: TransUnion, Experian, and Equifax. They keep track of these types of activity:

- Car Loan Payment History

- Credit Card Payment History

- Real Estate Loans

- Hard Inquiries

- Public Records

- Collections

CRAs evaluate and report if and when you repay money to a lender as outlined in a contract. If you fail to make payments, credit reporting agencies add negative remarks to your credit report. The more derogatory remarks on your credit report, the harder it becomes to borrow money. Therefore, your three credit reports are vital to your financial success. In fact, your credit report is one of the core building blocks to financial wealth.

Credit Score

Credit score is a numeric value determined by the information on your credit report. Credit scores are used by lenders to indicate how likely you are to pay back a loan. The higher a credit score, the greater the likelihood that you’ll pay back a loan.

Credit scores range from 300 (lowest) to 850 (highest) and are broken into five categories:

- Best Credit Score

- 850 – 800 Exceptional

- 799 – 740 Very Good

- Poor Credit Score: Hard to Obtain a Loan

- 739 – 670 Good

- 669 – 580 Fair

- 579 – 300 Very Poor

FICO and Vantage Score are the two most common ways lenders run a credit report. Let’s explore how FICO and Vantage Score calculate credit scores:

FICO

- 6 months of credit history

- 1 account reported within the last 6 months

- Treats all late payments the same

- 45-day span to dedupe credit inquiries

- Ignores all collections where the original balance was under $100

Vantage Score

- 1 month of credit history

- 1 account reported in the last 2 years

- Late mortgage payments penalized more harshly

- 14-day span to dedupe credit inquiries

- Ignores only paid collection accounts, regardless of the original balance amount

Credit Score Impacts

Despite the differences between FICO and Vantage Score, the following categories have the highest impact on a credit score:

- Payment History: a record of all payments made on an account. Good payment records tell lenders you are a low risk of defaulting on a loan. A bad payment history illustrates you are high risk, which will affect your credit for 7 to 10 years.

- Credit Usage: how much of your available credit you utilize. You should not use more than 15% of credit at any time. Credit usage over 15% will drop your credit score – the higher the percentage, the lower the score becomes.

- Derogatory Marks: negative marks on your credit that indicate you did not pay a loan per the agreement. Derogatory marks will stay on a credit report for 7 to 10 years.

- Age of Credit: how long you’ve had lines of credit. The longer a line of credit is open and active, the better it is for your credit score.

Personal Net Worth: Financial Planning 101

What is personal net worth? Do you know what it means, how it affects you, or how to calculate it? Calculating your net worth is an essential tool in your financial toolbox because it plays a vital role in achieving financial health and wealth. Net worth is the most important measure of a person’s financial status at any given time. Continue reading to learn about the basics of personal net worth to help you plan for a successful financial future.

What Is Net Worth?

Net worth is the dollar value of your assets minus the dollar value of your liabilities. Very simply, it is a snapshot of your financial status during a given time. Since personal net worth fluctuates as assets and liabilities change, it is important to use other tools when determining your financial health. For example, let’s say your net worth is –$5,000, you earn $100,000 annually, and your debt is solely a low-interest car loan. Conversely, you have a net worth of $5,000, earn $20,000 annually, and have children. Would you prefer the negative or positive net worth? We’re willing to bet you chose negative net worth. It’s important to realize negative net worth is not necessarily bad or an indication of financial trouble.

Personal Assets: A Beginner’s Guide

Personal assets are things you own that have a monetary value, like a house or stocks. It is important to know what your assets are worth to help you protect them and achieve your financial goals. Here are a few reasons it’s important to know your asset value:

- Retirement: having a large sum of assets will replace your salary and cover your living expenses.

- Insurance: identifying and insuring assets will help you protect them in the event of an accident, natural disaster, or theft.

Examples of Personal Assets

There are several types of personal assets, but for the sake of this article, we are only going to discuss four.

- Non-qualified assets are taxable investments such as brokerage accounts and checking or savings accounts.

- Retirement assets are tax-deferred investments like 401(k), 403(b), rollover IRA, or SEP-IRA plans.

- Real estate assets include your primary residence, vacation homes, rental properties, and land.

- Personal assets include personal items such as automobiles, jewelry, or art.

Personal Liabilities

Personal liabilities are debts that you owe to someone, like a mortgage or student loans. The debts can be large or small and vary from person to person. It is important to track your liabilities to manage your debt and achieve financial stability.

Examples of Personal Liabilities

Personal liabilities can be broken into the following categories:

- Short-term liabilities: home equity lines and credit cards.

- Long-term liabilities include primary residence mortgage, real estate loans, auto loans, and personal loans.

Determine Your Personal Net Worth

Assets – Liabilities = Net Worth

This amount is your financial worth on any given day.

How to Track Your Net Worth

Need help tracking your net worth? Our FMF365 net worth tracking system can do all the work for you. Find out your value today!

Compound Interest: Everything You Need to Know

Compound interest (or compounding interest) is one of the most important forces to manage your personal finances. Why? It can help or hurt you. For example, compounding interest can help you earn a higher return on your investments. On the other hand, it can increase your debt when you have interest compounding on loans. If we’ve piqued your interest, keep reading to learn more about compound interest.

What Is Compound Interest?

Compound interest is the addition of interest to the principal sum of a loan or deposit. Simply put, it is interest on your interest. As a result, the sum of an investment or loan grows quickly. For example:

- Year 1: Invest $10,000 and earn 10% interest = $1000 interest

- Year 2: Invest $11,000 and earn 10% interest = $1100 interest

- Year 3: Invest $12,100 and earn 10% interest = $1210 interest

As you can see, you can continually earn money even if you don’t make any deposits. The opposite is true of loans. Your loan balance can increase over time even if you don’t take out additional loans.

The frequency of compound interest can vary from daily to annually. The greater the frequency, the greater the return. Let’s take a look at $20,000 at 8% interest compounded at varying frequencies.

| Time | Daily | Monthly | Quarterly | Annually |

|---|---|---|---|---|

| 1 year | $21,665.55 | $21,659.99 | $21,648.64 | $21,600.00 |

| 10 years | $44,506.92 | $44,392.80 | $44,160.79 | $43,178.50 |

| 20 years | $99,043.28 | $98,536.06 | $97,508.78 | $93,219.14 |

Calculating Compounding Interest

You can use the following formula to calculate compound interest:

A = P(1+[r/n])^nt

- A: amount

- P: principal

- r: interest rate

- n: number of compounding periods per year

- t: time

Let’s calculate a few problems.

- $100 invested monthly; interest compounded monthly; 40 years; 8% growth

- A = 100(1+[.08/12])^12*40

- A = $351,528.12

- $500 invested monthly; interest compounded semiannually; 10 years; 3% growth

- A = 500(1+[.03/2])^2*10

- A = $70,044.43

Compounding Interest and Benjamin Franklin

Benjamin Franklin is known for many accomplishments, such as being one of America’s Founding Fathers, a writer, an inventor, and more. But did you know he was interested in finance, specifically compounding interest? When Franklin died, he left $4,400 to his two favorite cities, Philadelphia and Boston. He requested the money be placed in a trust untouched but invested for 100 years. At 100 years, nearly 75% of the trust was used to fund civic projects and help tradesmen. The remaining balance was reinvested for another 100 years. By 1990, the combined balances for Philadelphia and Boston were an astounding $6.5 million.

Boost Your Savings and Investments

Ready to increase the return on your savings and investments? Use our robo-advisor to start investing today. It’s as simple as point, click, invest.

Saving Money 101

As we learned in the Compound Interest section, it is important to stick to a steady disciplined strategy of continual savings. Why? Because you cannot predict the future. So, it is important to save money to prepare for unexpected expenses. It is also important to save money for financial security. The amount of money you save depends on your goals, income, and liabilities. But whatever your savings goals are, you need to do that before everything else, which includes eating and paying your cell phone bill. Keep reading to learn about the importance of savings and paying yourself first.

Importance of Saving Money?

Saving money is a basic financial rule. Despite its importance, most people do not save money regularly. Let’s take a look at four reasons why it’s important to save money:

- Emergency fund – From house repairs to loss of employment or an unexpected illness, things happen. That is why it is important to save money to prepare for emergencies and avoid increasing your debt.

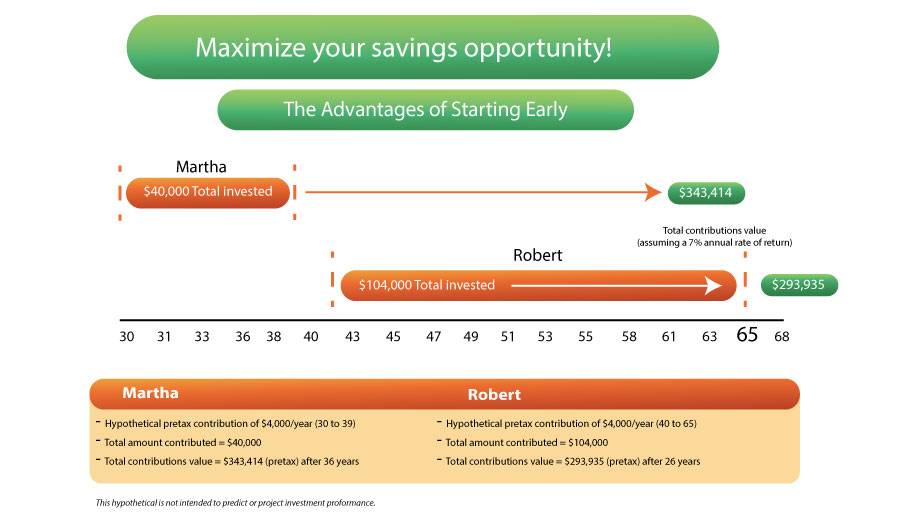

- Retirement – If you want to retire, you’ll need to replace your income with savings. The earlier you save for retirement, the better.

- Education – Whether you’re going to school or paying for your children, it is important to set aside money for the rising costs of education.

- Hobbies – Everyone likes to have fun from time to time, so save money for your hobbies, e.g., vacation, sports, etc.

How to Save Money

Saving money is not as hard as you may think. You can save the following ways every month:

- Company 401(k) – easiest way to save regularly

- Roth or traditional IRA investing

- Brokerage account investments – fewer restrictions than retirement accounts

- Savings account – deposit a portion of your check into your savings account every pay period

Start Saving Today!

It’s never too late to start saving. If you haven’t started saving money, start today. Every penny counts. Use our robo-advisor investment tool to prepare for unexpected emergencies.

Life Insurance: The Basics

How much do you know about life insurance? Maybe, like many people, you understand that it’s important without being clear on the specifics. If so, read on for a life insurance primer that will help you take the first steps.

Life Insurance: Purpose and Types

Let’s start by defining life insurance and its purpose. Life insurance is a way of creating an estate upon the death of the policyholder, whose beneficiaries receive money from the life insurance company. The purpose of life insurance is to cover the expenses that the policyholder is responsible for. So you should have enough life insurance to cover all your short- and long-term debts, including mortgage and any other debts, like a car loan. It should also replace the lost income that you won’t be around to provide. And there’s no need to be covered for more – you don’t want to be worth more dead than alive.

Now let’s get into the weeds of different types of life insurance. There are two main types: term life insurance and permanent life insurance.

- Term life insurance is a pure insurance policy, where you pay a premium in exchange for a death benefit for a specified period of time. The policy has no cash value, meaning that you don’t get any benefit from it during your lifetime. The older you are, the pricier it is to purchase a term insurance policy.

- A permanent life insurance policy has much higher premiums but provides both a death benefit and some cash value. There are different flavors of permanent insurance, like whole life, universal life, and variable life insurance.

Here are a few important things to remember about term life insurance vs. permanent life insurance:

- Nobody buys permanent life insurance products . . . permanent insurance is sold to people.

- Term life insurance is an easy and smart way to cover your family for the worst-case scenario.

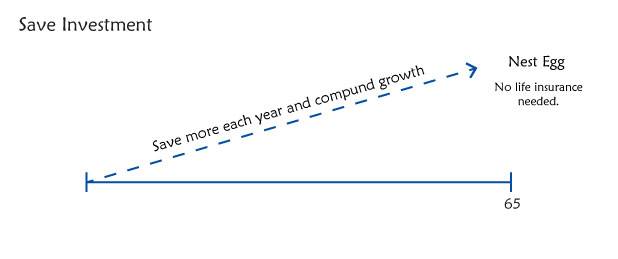

- But life insurance is just that – insurance, not a retirement plan. Life insurance supports your family in the unlikely event that you die before your time; a retirement plan supports you in the more likely event that you live to enjoy retirement.

Life Insurance Strategy

So what’s the best way to maximize future security and minimize up-front cost? First, look to term life insurance. We mentioned that premiums for permanent life insurance are much higher than for term insurance. That’s because all of us are guaranteed to die at some point. But term life insurance premiums depend on the likelihood of the policyholder living to a certain age. That means a 25-year-old can buy 30-year term life insurance for practically nothing per month. Why? Because of the very low risk that a 25-year-old won’t live to age 55.

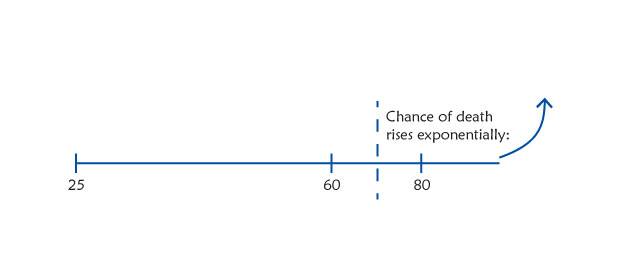

But buying term life insurance young isn’t necessarily a great value because that risk is so low. The best coverage cost/benefit value comes when a 35- to 40-year-old buys a new 30-year policy, because the chances of dying begin to rise exponentially toward the end of that term, ages 65 to 70, while premiums remain relatively low.

A good basic plan is to

- buy cheap term life insurance and

- save and invest the money you aren’t spending on permanent life insurance.

That investment, as it grows over time thanks to the magic of compound interest, will become a nest egg that might make your death benefit look like peanuts.

Automobiles: Depreciating Assets

Everyone loves a great ride, and for many of us, the kind of car we drive is part of our identity. But when you’re trying to build up your assets and net worth, splurging on a depreciating asset is a huge mistake. Depreciating assets become less valuable over time, and you don’t need a degree in finance to see how that can endanger your financial security. But you may be surprised at just how financially harmful it can be to overpay for a car.

Automobile Negative Vortex

When you’re in the market for a car, it’s natural to want one you love, and many dealerships exploit that desire to push people into expensive loans for their dream car. But the truth is, cars tend to become unloved by year 3. That shiny new ride isn’t so shiny anymore, and expensive repairs often start cropping up in years 3 to 5, just as you’re nearing the end of that five-year installment loan.

I’ve seen this vicious cycle so often that I’ve nicknamed it the Automobile Negative Vortex, or ANV. Here’s how it goes:

- Buy first car for $20,000 with a five-year loan.

- Enjoy and love the car for the first two years.

- By year three, minor problems begin showing up due to age/wear and tear.

- By year four, tired of the issues, you trade in the car before the loan ends, resulting in $5,000 negative equity.

- Buy second car for $25,000 plus $5,000 negative equity. Let’s say your credit score is less than perfect – maybe you’ve missed some credit-card payments or defaulted on a cell-phone agreement – so you agree to a new loan for $30,000 with six years of payments at 25% interest.

- That $30,000 loan breaks down to 72 monthly payments of $808, meaning the total amount repaid over six years will be $58,184, with $28,184 of that in interest! The price of your car just doubled, and paying all that extra interest will definitely restrict your cash flow. Is your beautiful, shiny new car worth it?

- At month 37 of the new loan, halfway through the term, your loan balance is now $20,324, you’re starting to see those repairs crop up again, and you wonder how you got sucked into this ANV. You may end up putting those repairs on your credit card at 29% interest, and the cycle continues. See how vicious it can get?

Strategy

Now, here are a few simple suggestions that will help keep you from becoming a victim of the ANV.

- Buy used, not new. A car that’s three years old will still be in overall good shape, but you’ll pay much less for it because the bulk of depreciation happens in the first few years of a car’s life. That means the previous owner, not you, takes the hit of that steep drop in value.

- Buy only as much car as you can afford. Before car shopping, take a look at your budget and figure out how much you can comfortably pay per month – then find a car within that budget. Don’t compromise the rest of your finances with car payments that are a stretch.

- Keep up with maintenance. You might be tempted to skip your car’s regular maintenance appointments to save money, but odds are, doing so will translate into more expensive repairs later.

- Drive your car until the wheels fall off. Not literally, of course, but the longer you can keep your car on the road in good condition, the longer you’ll enjoy a lifestyle free of car payments. Your checkbook will thank you.

The Rule of 72

The Rule of 72 is a classic mental math investment equation – a quick way to determine the number of years it will take to double your money with compounding interest. Although the Rule of 72 is the standard form of this investment rule, the Rule of 69 would actually be a more accurate way to calculate compounding interest. The reason why the rule of 72 was chosen instead is that it makes calculations easier, being evenly divisible by 1, 2, 3, 4, 6, 8, 9, and 12. For example:

- 2% rate of return: 72 ÷ 2 = 36 years to double

- 5% rate of return: 72 ÷ 5 = 14.4 years to double

Rule of 69

These days we all have a smartphone in our pocket, so there’s no need for mental math. Instead, for more accurate results, we’ll use the following Rule of 69 formula to calculate the doubling time of an investment:

69 ÷ percentage rate of return = number of years to double

Let’s take a look at Rule of 69 examples:

- 2% rate of return: 69 ÷ 2 = 34.5 years to double

- 5% rate of return: 69 ÷ 5 = 13.8 years to double

- 8% rate of return: 69 ÷ 8 = 8.6 years to double

Clearly, increasing the rate of return shortens the doubling time. Another way to think of it: even a small increase in rate of return can make a huge difference in the long-term health of your investment.