Social Security & Medicare 101

Let’s go to a different time in America, the early 1920s – an age of dramatic social and political change. For the first time in American history, more people lived in cities than on farms. As a result, the nation’s total wealth more than doubled between 1920 and 1929. This economic growth swept many Americans into an affluent but unfamiliar “consumer society.”

Mass Culture

This economic growth meant many Americans had extra money to spend and led to mass culture, including:

- Ready-to-wear clothing

- Electric goods (e.g., radio, television, appliances, and more)

Unfortunately, all good things come to an end, and the boom times of the 1920s were followed by the Great Depression. As a result, Social Security and Medicare were created. Explore this section to learn about the history of Social Security and Medicare, Social Security benefits, how Social Security works, when to collect Social Security, Medicare program, who’s eligible for Medicare, common questions, and the FMF Social Security analyzer.

Social Security & Medicare History

Before 1935, America did not have a national retirement system. But after the Great Depression, the United States government saw the need to create a federal retirement system designed to provide basic financial security for three groups:

- Retirees

- 1934 – the average life expectancy was 60 for a male and 64 for a female, but that average was misleading because of high infant mortality; in fact, 54% of 21-year-old men could expect to live to 65, and 65-year-old men could expect to live to 78

- 1935 – the only claiming age was 65 years old

- 1937 to 1939 – one-time lump sum payments were the only payment option

- 1940 – first monthly retirement check mailed out

- 1940 – Ida May Fuller began collecting Social Security at age 65

- 1975 – Ida died at age 100

- Folks with disabilities

- Family members of a wage earner who has died

Ida May Fuller

The Social Security website tells a great story about Ida May Fuller that illustrates the history of how Social Security benefits increased. Let’s take a look.

1940 – First checks sent out.

- Ida received $22.54 per month

1950 – First benefit increase enacted by Congress.

- 77% increase

- After 10 years at $22.54 a month, Ida began receiving $41.30 in October 1950

1952 – Second increase of 12.50% goes into effect.

All subsequent increases were by special legislation until 1975.

1975 – Automatic annual increases go into effect.

- Increase is meant to cover annual cost of living increase

- No longer does inflation erode Social Security benefits

2018 – Cost of living adjustment = 2.8% effective for payments starting January 2019.

Medicare – A National Health Insurance Fund

The history of Medicare goes back to President Teddy Roosevelt. In 1912, his presidential campaign included a national health insurance plan. The idea of a national health plan didn’t gain steam until 1945, when President Harry S. Truman championed it. He wanted national health insurance for all Americans and fought to pass a bill but was unsuccessful. It took another 20 years before Medicare became a reality.

John F. Kennedy – Medicare Push

After studies showed that 56% of Americans over the age of 65 were not covered by health insurance, JFK made an unsuccessful push for a national healthcare plan. But it wasn’t until after legislation was signed by President Lyndon B. Johnson in 1965 that Americans began receiving Medicare health coverage.

Medicare and Social Security Coverage

Have questions about your Medicare and Social Security coverage? If so, we can help. Use our FMF365 Social Security Analyzer to learn about your benefits and eligibility.

Social Security Benefits

We often do not realize how important Social Security benefits are. Social Security represents the largest source of retirement income for 53% of married couples and 74% of unmarried people. Social Security is one of the only sources of guaranteed income. Since Social Security adjusts each year as cost of living increases, retirees can count on their payments to keep up with inflation and the cost of goods needed for the rest of their life.

Role of Social Security Benefits

While Social Security isn’t designed to be a person’s entire retirement income, it is designed to replace between 27% and 41% of a person’s income before retirement. Here’s a small sample of how Social Security is designed to replace a person’s pre-retirement income. You’ll notice it’s designed so lower-income folks receive a larger percentage of their income.

| Salary before Retirement | Monthly Social Security Payment | First Year Social Security Payments | Replacement Ratio |

|---|---|---|---|

| $30,000 | $1,014 | $12,168 | 41% |

| $40,000 | $1,224 | $14,688 | 37% |

| $60,000 | $1,376 | $16,512 | 28% |

| $118,500 | $2,642 | $31,956 | 27% |

It’s very important to note that folks earning more than the Social Security cap limit of $118,500 stop paying Social Security tax on their earnings above that limit, but keep in mind their Social Security payment is maxed out at $2,642 as of 2018.

Determine Your Social Security Benefits

Have questions about Social Security benefits? Use our FMF Social Security Analyzer for information about retirement, disability, survivor, and dependent benefits.

How Does Social Security Work?

Whether you’re just starting your career or ready to attend your retirement party, it is important for you to understand how Social Security works. Doing so will help you prepare for a fun and carefree retirement. Despite all of the Social Security resources, there is a lot of confusion about how Social Security works. So, let’s take a look at how Social Security works.

Social Security Taxes and Eligibility

Social Security works by collecting the American workforce’s tax contributions and then using them to pay out benefits to eligible people. If you’re a citizen of the United States, you’re eligible for retirement assistance through Social Security. It was created to provide retirement assistance for U.S. employees who pay FICA taxes. The Social Security Administration collects a total of 12.4% tax on earnings. In other words, your employer pays 6.2% and you pay 6.2% to fund Social Security benefits. For example, let’s say you pay Social Security taxes. You can earn up to four “tax credits” per year, according to your income level:

- $1,360 in wages will earn you one credit, or

- $5,440 in wages will earn you the maximum four credits.

All in all, Social Security requires you to earn 40 credits to be eligible for retirement benefits (or 10 years of work minimum).

What Social Security Wages Are Used?

Your lifetime earnings are used to calculate your benefit amount. Each year of earnings is recorded in the Social Security system. Your actual earnings are adjusted to account for changes in average wages since your wages were earned – that is, they are indexed. For example,

- $24,000 earned in 1997 x (change rate since 1997 to calculated year) = adjusted wage

If you want to calculate your average indexed monthly income, you’ll need up to 35 years of earnings. After the Social Security Office determines how many years you’ve earned wages, they will:

- Select the years with the highest earnings

- Sum the indexed earnings and divide the total amount by the total number of months in those years

- Round the average amount down to the nearest dollar

And there you have it – your average indexed monthly income.

When to Collect Social Security

Social Security estimates that a man reaching 65 today can expect to live to age 84 on average, a woman to 86.

When to Claim Social Security Benefits

The age when you first claim your benefits is important, because your benefit will be reduced if you begin claiming it before your full retirement age. Depending on your birth year, your full retirement age is anywhere from 66 to 67 years old, as shown in the table below. If you begin claiming your benefit then, you receive the full PIA (primary insurance amount). But the PIA is reduced proportionally if you begin claiming earlier – and, if you do so, you’re locking in the reduced benefit amount for the rest of your life. So think long and hard before deciding to claim early.

| Birth Year | Full Retirement Age | Percent Reduction of PIA If Benefits First Claimed at Age 62 |

|---|---|---|

| 1943–1954 | 66 | 25% |

| 1955 | 66 + 2 months | 25.83% |

| 1956 | 66 + 4 months | 26.67% |

| 1957 | 66 + 6 months | 27.50% |

| 1958 | 66 + 8 months | 28.33% |

| 1959 | 66 + 10 months | 29.17% |

| 1960+ | 67 | 30.00% |

Calculate Your Social Security Benefits

Have questions about Social Security benefits? Our financial advising firm can help. Use our FMF Social Security Analyzer for information about when and how to collect your benefits.

Medicare Program

In 2019, most Medicare beneficiaries will pay a standard premium of $135.50. Medicare beneficiaries whose modified adjusted gross income (MAGI) tops $85,000 ($170,000 for couples) pay higher premiums for both Medicare Part B and Part D prescription drug program.

If your MAGI exceeds any of the six income tiers by even one dollar, you jump into the next grid tier and will be paying even more for both Medicare B and D. Premium prices for the various income brackets are shown in the table below.

| Single | Married Couples | Part B | Part D |

|---|---|---|---|

| <$85,000 | <$170,000 | $135.50 | Plan Premium |

| $85,000–$107,000 | $170,000–$214,000 | $189.60 | Plan Premium + $12.40 |

| $107,000–$133,500 | $214,000–$267,000 | $270.90 | Plan Premium + $31.90 |

| $133,500–$160,000 | $267,000–$320,000 | $352.20 | Plan Premium + $51.90 |

| $160,000–$500,000 | $320,000–$750,000 | $433.40 | Plan Premium + $70.90 |

| +$500,000 | +$750,000 | $460.50 | Plan Premium + $77.40 |

Medicare Premiums

Medicare premiums reset each year and take effect the following January 1. If your income falls in future years, your Medicare premiums will fall too.

Medicare Stipulations

Once you enroll in Medicare, you can no longer contribute to an HSA. If you decide to receive Social Security benefits, then you must enroll in Medicare Part A, if age 65 or older. Medicare Part A has zero premiums (assuming you meet eligibility).

What Are My Medicare Choices?

Original Medicare or Medicare Advantage Plan

There are two main ways to get your Medicare coverage. Refer to the Medicare Coverage Choices Sheet for a quick overview.

Have More Questions about Medicare?

If you have more questions about Medicare, visit the Social Security and Medicare section. If you’re ready to start investing, we can help. Use our digital investment tools to select the best portfolio and, more importantly, achieve financial health and wealth.

Who’s Eligible for Medicare?

Who is eligible for Medicare? What age do I have to be to receive Medicare? Am I eligible to receive Medicare if I have a health problem or disability? For answers to these questions and more, keep reading. Our financial investing office is dedicated to providing wealth management information for the 21st century.

Medicare Eligibility

If you are 65 years of age, have been a legal resident of the United States for at least five years, and have paid Medicare taxes for at least 10 years, you are eligible for Medicare. Those under 65 who are disabled and have been receiving Social Security disability benefits for at least 24 months are eligible to enroll in Medicare. Also, people who get continuing dialysis for end-stage renal disease or need a kidney transplant are eligible for Medicare. Lastly, people who are eligible for Social Security Disability Insurance and have ALS or Lou Gehrig’s disease are eligible for Medicare.

Medicare Administration and Enrollment

Medicare is administered by the Centers for Medicare and Medicaid Services (CMS). Or you can enroll through the Social Security Administration office.

When Can You Sign Up for Medicare?

Medicare enrollment periods are as follows:

- Initial – at age 65. You have a seven-month initial enrollment period, extending from three months before the month of your 65th birthday to three months after the month of your 65th birthday

- Special – If you delayed enrollment due to a current employer plan, you will have eight months after the end of employment to enroll in Medicare

- General – January to March each year

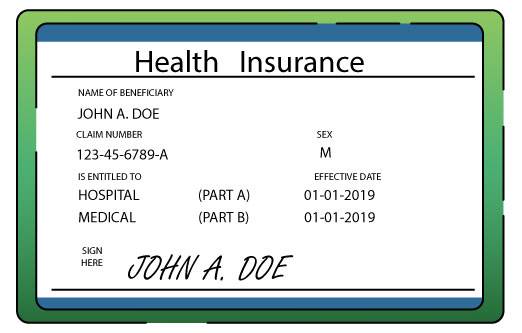

Types of Medicare

Medicare Part A

- Hospital insurance

- Covers most inpatient hospital expenses (room, food, taxes)

- Maximum stay 90 days

- Medicare covers the first 60 days, except one co-pay of $1,364

- Days 61 to 90 require a co-pay of $341 per day

- Also covers skilled nursing care, home health care, and hospice care

Medicare Part B

- Medical insurance – coverage begins once the $185 deductible is paid

- Doctors’ services and outpatient care

- Preventative services

- Diagnostic tests

- Some therapies

- Durable medical equipment

Medicare Part D

Part D covers outpatient prescription drugs. Plans are chosen each calendar year based on your needs. Medi Gap insurance policies customized to your healthcare needs are also selected each year.

Want More Information about Medicare?

For more information about Social Security and Medicare, contact:

- Social Security

- Call 1-800-772-1213

- Website: www.ssa.gov

- Medicare

- Call 1-800-MEDICARE

- Website: www.medicare.gov

For help with retirement investments, use our robo-investor tool. It’s quick, easy, and hassle-free. Start investing today.

Social Security and Medicare Common Questions

Q: Can I delay Medicare beyond age 65 if I have insurance from an employer?

A: If the employer has 20 or more employees, you can delay Medicare enrollment until the job ends. You could, however, sign up for Medicare Part A only as a secondary insurance to your current employer plan.

Q: What if I have retiree health benefits or COBRA?

A: Retiree benefits and COBRA do not count as employer-provided coverage; you will need to sign up for Medicare.

Q: What happens if I don’t enroll at the right time?

A: You will have to sign up at a general enrollment time (coverage begins that July 1st). You will also have to pay Medicare penalties that will be added to your premiums for all future years.

Q: Can I have both Medicare and employer-provided insurance after age 65?

A: Again, the employer plan will be the primary, so it’s unlikely Medicare Part B would be worth the cost of paying the premium.

Q: What if my employer’s health plan includes a health savings account?

A: Once you enroll in any part of Medicare, you can no longer contribute to HSA accounts. You can draw on HSA funds but can’t add any.

Q: Where can I go for more info?

A: Social Security:

- Call 1-800-772-1213

- Website: www.ssa.gov

A: Medicare:

- Call 1-800-MEDICARE

- Website: www.medicare.gov

Social Security and Medicare

Have more questions about Social Security and Medicare? If so, visit our Social Security and Medicare 101.

Fill the fields below and we’ll email you a list of SS benefit election strategies.

Determine Your Monthly Social Security Income

If you’re not a numbers person and need help calculating your average indexed monthly Social Security income, we can help. Use our FMF Social Security Analyzer to determine your income in five minutes or less.