Financial Investing for Beginners: The Complete Guide

Put simply, a financial investment is an act of making your assets work for you. When done properly, a financial investment can help you generate large profits over time. On the other hand, poor financial investment decisions can cause you to lose money. Despite the risk, if you don’t invest your money, you are missing out on opportunities to increase your financial worth.

Whether it’s an IRA, stocks, bonds, savings account, or a combination of assets, it is important to invest to achieve financial health and wealth. Smart investment decisions ensure financial security now and in the future. If we’ve piqued your interest and you want to learn more about financial investing, we are here to help. The FMF365 team highlighted seven sections of personal finance – stock market indices, investing in blue-chip companies, understanding risk and assets, market cap, growth vs. value, mutual funds, and fixed annuities – to help you achieve financial health and wealth.

Stock Market Indices

Those long columns of abbreviations and numbers in the financial section of the newspaper might seem mysterious, but we’re about to shed some light on them by walking you through the basics of stock market indices. Keep reading to learn about the stock market index, Dow Jones, S&P 500, and more.

What Is the Stock Market Index?

A stock market index is a tool used by investors to describe the market by categorizing stocks into groups and measuring their performance. Examples of stock market indices are the Dow Jones Industrial Average (DJIA), the S&P 500, and the small-company index, the Russell 2000. We’ll get into more depth about the Dow Jones Index and the S&P 500 Index before giving you some strategic advice for your own investments.

Dow Jones Index

The Dow Jones Index was created by partners Charles Dow and Edward Jones in 1896. The Dow Jones Index is a market-capitalized index that currently consists of the 30 largest U.S.-based companies. Each of those companies has a particular weighting within the stock market index. Price changes in the stocks of the 30 companies move the price of the Dow Jones Index – that is, it’s a price-weighted index. So if a single company in the Dow 30 has a bad day, its drop in price can drag down the whole index.

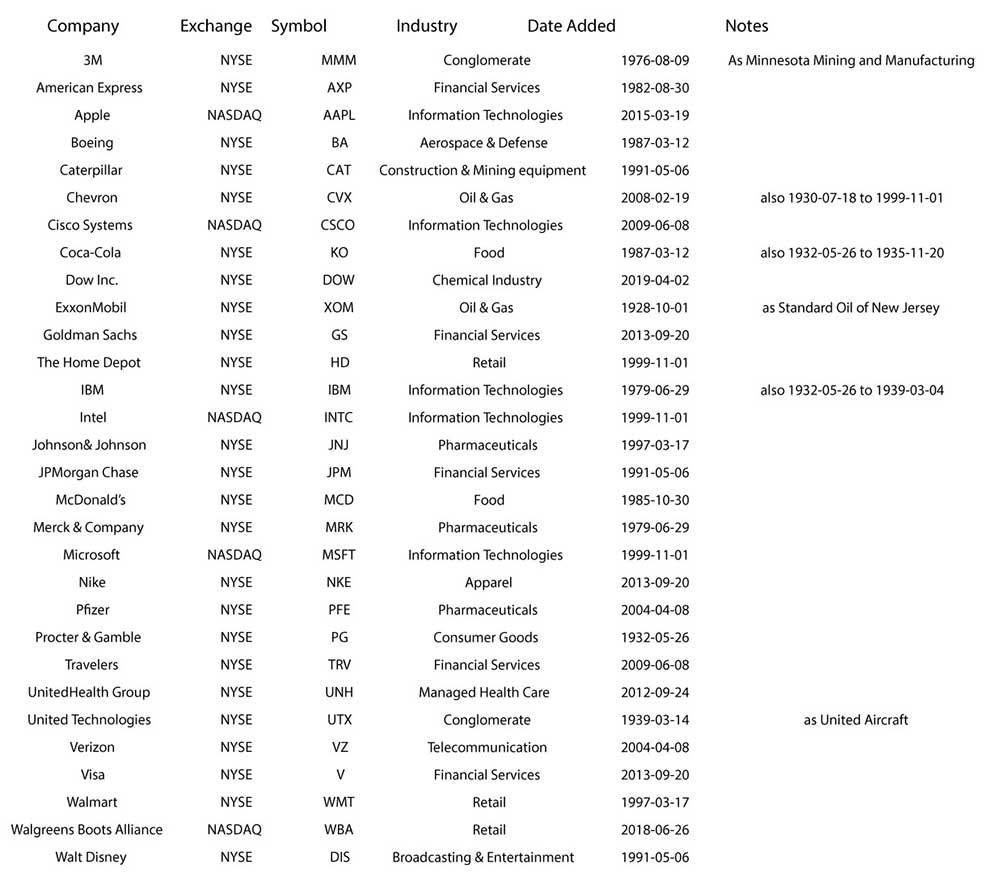

Dow 30 Companies

Here’s what the Dow 30 looks like today:

You might notice that the companies in the current Dow 30, like Apple, Cisco Systems, and Visa, have very little to do with traditional heavy industry. However, they’re a huge part of the modern American economy of 2019. Also, the Dow 30 companies are all represented in the S&P 500 Index – you’ll see why shortly.

S&P 500 Index

The S&P 500 Index is probably the most widely followed of all market indices because it’s considered the best representation of the U.S. stock market. As the name suggests, it consists of the 500 largest U.S.-based companies, which is why you’ll find all of the Dow 30 companies in the S&P 500 Index as well. The weighting of the companies within the S&P 500 Index is by market capitalization. That means the impact of the individual stock price on the overall index is proportionate to the company size relative to the total market capitalization of the index. So the very largest companies, with market caps in the neighborhood of $1 trillion, will have a far greater impact on the index than a company with a market cap of $25 billion – still large, but only about a quarter the size of the giants.

S&P 150 Companies

Here’s a list of the top 150 companies in the current S&P 500:

Stock Market Investing Strategy

How can this knowledge help you decide where to put your money? First, consider the stock market indices’ differences in weighting. Indices weighted by market capitalization are heavily influenced by the top dozen or so companies, which can account for around 40 percent of the index’s moves. Being so dependent on a handful of companies isn’t wise – even the best-established, highest-performing companies aren’t guaranteed to stay that way.

To diversify your investment and reduce your risk, consider an equal-weighted strategy, which disregards company size so the weighting is spread equally. Instead of relying on the top ten holdings of the stock market index, many of which are technology companies – meaning your portfolio isn’t very diversified – an equal-weighted strategy distributes your investment among a larger number of companies. That diversification cuts your risk and makes for potentially better returns over the long haul.

Investing in Blue-Chip Companies

Have you ever wondered what a blue-chip company is and where the term came from? It’s pretty simple – a blue-chip company is one of the largest and most prestigious in its industry. The term dates back to the late 19th century and refers to the highest-value chip at the poker table, which was always blue.

What Are Blue-Chip Companies?

Blue-chip companies generally are well-established household names with highly regarded management teams and large market caps. They have steady historical growth, excellent creditworthiness, and a bright future. Blue-chip stocks usually pay dividends offering consistent returns no matter the overall economic conditions. For all of these reasons, blue-chip companies are a strong investment choice.

Blue-Chip Companies’ Disadvantages

However, there are a couple of potential downsides to investing in blue-chip companies. Don’t forget that no investment is guaranteed and that even a company with a long, solid history could tank. Also, because the companies are so large and well known, their stock prices per share tend to be very expensive, and dividends usually aren’t that large.

Identifying Blue-Chip Companies

When it comes to identifying blue-chip companies, you already know many of them: 3M, Amazon, American Express, Costco, Disney, IBM, McDonald’s, Nike, Starbucks, and Walmart are just some examples. The Dow 30 and the S&P 150 have lots more large-cap, blue-chip companies.

And there’s a way to get more granular. The stock market can be broken down into eleven different sectors, each of which can include any number of industries. Since a blue-chip company is one that’s at the top of its industry, you can investigate certain industries and identify their heaviest hitters. The following list includes all eleven sectors and examples of industries within them. But any way you slice it, blue-chip companies are the closest thing to a sure thing that the stock market has to offer.

Technology Blue-Chip Industries

- Software

- IT services

- Semiconductors

- Hardware, storage, and peripherals

- Communications equipment

- Electronic equipment

Finance Blue-Chip Industries

- Banks

- Insurance

- Capital markets

- Diversified financial services

- Consumer finance

- Thrifts and mortgage finance

- Mortgage REITs

Healthcare Blue-Chip Industries

- Pharmaceuticals

- Healthcare equipment and supplies

- Biotechnology

- Healthcare providers and services

- Life sciences tools and services

- Healthcare technology

Consumer Discretionary Blue-Chip Industries

- Internet and direct marketing

- Hotels, restaurants, and leisure

- Specialty realty

- Automobiles

- Textiles, apparel, and luxury goods

- Household durables

- Multiline retail

- Diversified consumer services

- Auto components

- Leisure products

- Distributors

Communication Services Blue-Chip Industries

- Interactive media and services

- Diversified telecommunication services

- Entertainment

- Media

- Wireless telecommunication services

Industrial Blue-Chip Industries

- Aerospace and defense

- Machinery

- Road and rail

- Industrial conglomerates

- Professional services

- Commercial services

- Electrical equipment

- Air freight and logistics

- Airlines

- Trading companies

- Construction and engineering

- Transportation infrastructure

- Marine

Consumer Staples Blue-Chip Industries

- Beverages

- Food products

- Food and staples retailing

- Household products

- Personal products

- Tobacco

Energy Blue-Chip Industries

- Oil, gas, and combustible fuels

- Energy equipment and services

Materials Blue-Chip Industries

- Chemicals

- Metals and mining

- Containers and packaging

- Construction materials

- Paper and forest products

Utilities Blue-Chip Industries

- Electric utilities

- Multi utilities

- Independent power and renewable electricity producers

- Gas utilities

- Water utilities

Real Estate Blue-Chip Industries

- Equity REITs

- Real estate management and development

Investing in Blue-Chip Companies

Blue-chip companies are companies that you can typically rely on to thrive in good times and survive in the bad times.

Understanding Financial Risk and Asset Classes

Risk is all around us and occurs throughout our daily life. Although it is often used in different contexts, risk is defined as the possibility that a financial outcome or investment will not be as expected. If you’re unfamiliar with the different types of risk, we’re here to help. Keep reading to learn about financial risk and asset management.

Types of Financial Risk

Risk comes in many forms. But to help you in your financial decisions, let’s look at some of the specific categories of financial risk.

- Business risk: the chance that a company you invest in will fail.

- Volatility risk: the possibility of losing or making money on the fluctuation of stock markets due to events that aren’t in any one person’s control.

- Inflation risk: the likelihood that the things you buy will become more expensive over time, reducing the purchasing power of your money.

- Interest rate risk: the uncertainty of changes in the interest rate, which will have a direct effect on bond and stock prices.

- Liquidity risk: the chance you take in investing money such that you can’t easily get your hands on it if needed.

Financial Risk and Reward

All financial investments have a fundamental tradeoff between risk and return. Potentially higher returns on investment also entail a higher risk that you’ll lose your capital. You have to decide how much financial risk you’re willing to accept in exchange for the ability to make money. Let’s compare the financial risk and reward of two common types of public securities, stocks and bonds.

Stocks

To buy stocks means buying a percentage (in most cases, a tiny one) of ownership in a publicly traded company. The value of the stock is determined by the success of the company you are now a partial owner of. Buying stocks of individual companies is risky, in the specific sense of business risk, because the return on your investment is heavily dependent on the success or failure of one company. Investments that track the overall stock market spread out that business risk over many companies, so in spite of the volatility risk, they’re often much more rewarding in the long run. The historical annualized rate of return of the U.S. stock market from 1925 to 2018 is 9.8 percent (see chart) in spite of the Great Depression and many other recessions.

Bonds

When you buy bonds, you’re essentially lending money to a company or government; it’s the opposite of you taking out a loan from the bank. Your investment in a bond is repaid by earning a certain interest rate for a specified period, usually anywhere from three months to 30 years. Bonds tend to be secure but low-earning investments. They’re subject to inflation risk, in that a low interest rate might not even keep up with inflation over the years, and interest rate risk, in that you could miss out on greater returns if interest rates go up after you’re already locked into an investment. And for longer-term bonds, you also have liquidity risk in giving up access to that money for a long time.

Lower Your Financial Risk

Stocks can be bought and held in your FMF365 Investments account in any of our three stock-based investment strategies or our three mutual fund–based strategies. Contact Dan@firstmasonfinancial.com to learn more.

What Is Market Cap?

We talked briefly about market capitalization in the Stock Market Indices section of this guide, but it’s worth taking a deeper dive into what that means. Market capitalization, or market cap, is the total dollar value of a company’s outstanding stock shares. It’s calculated by multiplying the total number of shares by the current market price.

Market Capitalization Examples

Let’s look at two market cap examples:

- Example 1: Apple has 4.6 billion existing shares of stock. For the sake of calculation, we’ll say that one share of its stock is currently trading for around $200. So Apple’s market cap is 4.6 billion x $200 = $920 billion

- Example 2: Amazon has 492 million existing shares of stock. For the sake of calculation, we’ll say that one share of its stock is currently trading for around $1,900. So Amazon’s market cap is 492 million x $1,900 = $934.8 billion

Why Does Market Cap Size Matter?

The stock market can be categorized and ranked by market cap size as follows:

- Large market cap = more than $10 billion

- Examples: Apple, Microsoft, Berkshire Hathaway, JP Morgan, ExxonMobil, Johnson+Johnson, ProctorGamble, Disney, Amazon, Cisco, Chevron, Verizon, WellsFargo, Google, United Health Care, Intel, AT&T, Lockheed Martin, Visa, Nike

- Mid market cap = $2–10 billion

- Examples: Hilton, SBA Global, Square, Tyson Foods, FirstEnergy, FifthThird, Stanley Black+Decker, CoStar, Verisign, Hartford, Kroger

- Small market cap = less than $2 billion

- Examples: Roku, Zynga Haemonetics, Radian, PacWest, Flowers Foods, Howard Hughes, Chegg, Jabil, Spire, Hawaiian Electric, Silicon Labs, BluePrint Medicines, Murphy Oil, Brighthouse Financial

So, after seeing how each market capitalization category invests in different companies, ask yourself, “What would happen in a worst-case scenario?” – an economic recession. If the business environment were to change for the worse, would you want to invest in Zynga or Silicon Labs? We’re willing to guess you probably wouldn’t. It’s riskier to hold stock in smaller companies during recessions since they aren’t as well established and are likely to be hurt more by downturns. Bear in mind that if the economy remains robust, the small-cap companies have the greatest growth potential given their small size.

Consumers will still need toilet paper, laundry detergent, and phone and Internet service, though, regardless of the economic environment, so companies like ProctorGamble and AT&T will likely stay healthy in bad times and continue to grow in good times. Then again, during economic expansions, you could miss out on great returns on small-cap investments by leaning too far to the large-cap side.

This is why market cap size matters. Big blue-chip companies will grow during an expansion but also stay solvent when economic conditions become stormy. Keep in mind the most robust portfolios have a mix of large-, mid-, and small-cap companies. But the best proportions of each come down to your risk tolerance, net worth, and stage of life.

Build a Strong Portfolio

Build a strong portfolio with a mix of large-, mid-, and small-cap companies.

Growth vs. Value Stocks

We talked about why size matters in the Market Cap section, but it’s not all that matters. Another important metric used to analyze the stock market splits stocks into two groups: growth stocks and value stocks.

What Are Growth Stocks?

Companies with a very high growth rate are considered – not surprisingly – growth stocks. Sometimes these companies won’t show a profit, or maybe will even lose money, but the lack of profit can be deceptive. Fast-growing companies tend to reinvest profits into the company or funnel those profits into other business ventures to grow profits at an even faster rate. That’s why growth stocks typically don’t pay dividends to their shareholders.

Examples of growth stocks are Google, Apple, Facebook, Netflix, Home Depot, Uber, and Visa.

What Are Value Stocks?

When a company’s growth rate drops to a more modest level that’s sustainable over the long haul, its stock is considered value stock. Unlike growth stocks, many value stocks pay their shareholders dividends. Growth rates eventually level out at some point due to natural limits on the market for a company’s product or service.

For example, take electricity. The electric company can only sell so much electricity to you each month, and regardless of market conditions, you’re likely going to find a way to pay your electric bill. Thus electric companies provide stability to withstand any economic condition.

Examples of value stocks are Southern Co., AT&T, Pepsi, JP Morgan Chase, and Lockheed Martin.

Which Stocks Are Better?

So which is best – growth stocks or value stocks? In fact, both have merit in a diversified portfolio. A mix of growth and value stocks is an effective way to create a sturdy portfolio that can weather both upturns and downturns.

Build a Strong Portfolio

Build a foundation with a strong portfolio.

Mutual Funds

Before you know whether you want to invest in mutual funds, first you have to know what they are! Very simply, mutual funds are a pool of investor funds that are managed by an investment company. There are two main categories: actively managed funds and index funds.

Actively Managed Funds

As the name implies, actively managed funds are directed by financial professionals who decide where to invest the funds. The goal of actively managed funds is diversification and flexibility. Performance records and expenses are audited. Compared to other types of investments, actively managed funds are relatively low cost.

Passively Managed Index Funds

These types of funds simply mirror the underlying index rather than being directed by managers. They’re also diverse investments because the index is made up of so many different companies. The cost of index funds is even lower than actively managed funds.

Mutual Funds History

The very first opportunity for small-scale investors to invest in many different companies dates to 1774 when a Dutch merchant created a mutual fund with 2,000 units. Once they were all sold, the only way to own units was to buy them from a current owner – no more units were created. The money raised was diversified into various investments, which was the first opportunity for small investors to have multiple investments at once, thus spreading the risk more widely than was possible with any individual investment.

Mutual Funds in the 21st Century

Today, mutual funds can focus on different types of investments, like stocks, bonds, or stable investments. Even those categories can be further divided – investments in stocks could focus on large, stable companies like Microsoft, Apple, or Amazon, or they could focus on relatively small companies with market caps below $2 billion, like Owens-Corning, Energizer Corp., Builders First Source, or MGIC Investment Corp.

Mutual Funds Made Easy

Whatever the focus of the mutual fund, investing in one is a great way for any investor to have easy access to a diversified portfolio.