Want to start investing, but don’t know where to start? Let’s take a look at various risk profiles and what that means for your portfolio!

Portfolios

Your portfolio can be designed based upon your “Risk Profile”. When deciding between conservative, moderate, or aggressive strategies, it’s important to keep in mind the risk level you’re willing to take and the timeline for your financial goals.

Conservative

Moderate

Aggressive

Example Portfolio Breakdown:

Features:

- Professionally managed

- Low cost index mutual funds

- Low Cost ETF’s (Exchange Traded Funds)

- Risk-based algorithms

- GEODE capital management

Let’s talk about the type of investments you’ll own. You’ll get a fully diversified portfolio utilizing Fidelity Investments’ low cost index mutual funds and ETF’s (Exchange Traded Funds). Let’s zoom in on a few of the investments we utilize.

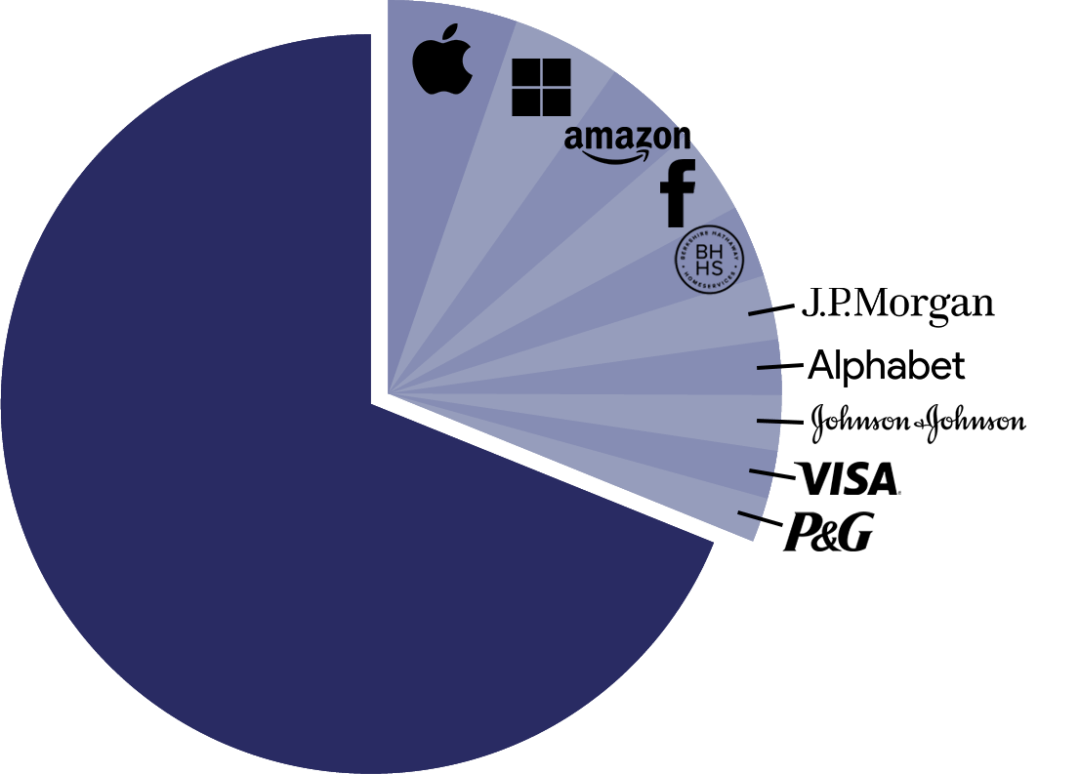

Fidelity 500 Index Fund

The total internal management cost are just 1.5 Basis points 0.015%

Holdings You’ll Own:

- Apple

- Microsoft

- Amazon

- Berkshire Hatheway

- JP Morgan

- Alphabet – Google

- Johnson & Johnson

- Visa

- Proctor & Gamble

+490 MORE!

This one mutual fund is just a portion of a % of your total investment!